- Diplomatic Area, Manama Centre, Kingdom of Bahrain

Call Us Today

Company Registration In Bahrain 2024

This article serves as a detailed roadmap for the intricate process of company registration in Bahrain. Beyond merely outlining the procedural steps, it delves into essential aspects such as prerequisites, advantages, associated expenses, the taxation system, and the requisite paperwork needed to successfully register a company in the Kingdom of Bahrain.

Embark on a journey of informed decision-making as we dissect the nuances of the business registration landscape in Bahrain, providing you with the insights needed to navigate this process seamlessly and position your company for success in this thriving economic hub.

Table of Contents

Company Registration In Bahrain In 2024

Nestled in the heart of the Middle East, the Kingdom of Bahrain stands as a beacon of business and corporate excellence. Among the leading GCC nations, Bahrain extends unparalleled opportunities for investment and the initiation of new business ventures. The recent findings of the Heritage Foundation’s Index of Economic Freedom for 2022 highlight Bahrain’s economic prowess, ranking it as the 74th-freest economy globally. Moreover, within the Middle East and North Africa region, Bahrain claims an impressive fourth position out of 14 nations.

Position your business for success by exploring the dynamic landscape of Bahrain’s business environment. Our guide to Company Registration in Bahrain for 2023-24 will navigate you through the seamless process, ensuring you harness the full potential of this vibrant economic hub.

Navigate the pathway to success with seamless company registration in Bahrain.

While Bahrain’s economy historically revolved around the extraction of crude oil, natural gas, and petroleum exports, the nation has strategically leveraged its rich history in trade and transportation. This strategic focus has propelled Bahrain ahead of certain Gulf counterparts, particularly in the development of the manufacturing sector and the provision of robust business and financial activities. Noteworthy is Bahrain’s appeal to entrepreneurs, both domestic and international, thanks to its zero corporate and income taxes.

Embark on a journey to understand the intricacies of Bahrain company registration with this comprehensive guide. Explore the procedural aspects, delve into the requirements, unravel the myriad benefits, gain insights into associated costs, unravel the taxation structure, and discover the essential documents needed for a successful company registration in Bahrain. Let’s pave the way for your business success in this thriving economic oasis.

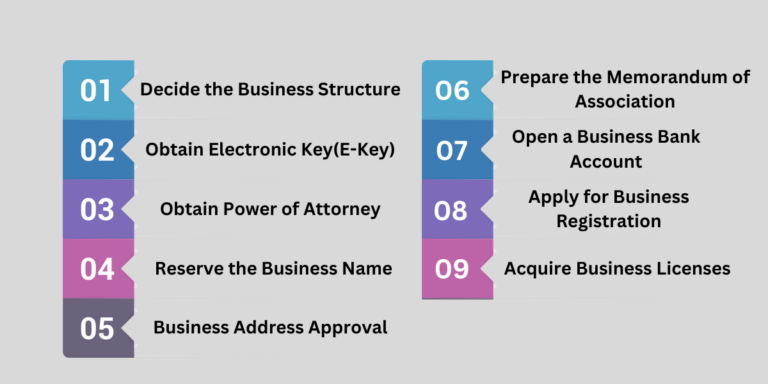

Procedure for company registration in Bahrain

Streamlining Your Path to Company Registration in Bahrain: A Step-by-Step Guide

the journey to register a company in Bahrain involves a series of crucial steps. Follow this comprehensive guide to navigate the process seamlessly:

Decide the Business Structure:

- The initial step is to define the corporate structure of your company and outline its activities.

Obtain Electronic Key:

- Enroll with the e-Government Authority in Bahrain to acquire the essential e-key.

Obtain Power of Attorney:

- In case the e-key is inaccessible, secure the Power of Attorney as an alternative.

Reserve the Business Name:

- With the acquired electronic key or Power of Attorney, reserve the business name post-authorization from the Ministry of Industry, Commerce, and Tourism (MOICT). Provide at least three potential business names for registration.

Business Address Approval:

- Obtain approval from the relevant authority for the official address of the corporation.

Prepare the Memorandum of Association:

- Draft a comprehensive Memorandum of Association for the business and submit it for authorization to the Ministry of Justice. Notarize the prepared memorandum through a private or public notary after receiving consent from the Ministry of Justice.

Open a Business Bank Account:

- Facilitate the company registration process by opening a business bank account and depositing the required capital.

Apply for Business Registration:

- File an application for company registration with the Ministry of Industry, Commerce, and Tourism (MoICT), including all necessary information and documents. Upon approval, the company will be officially registered.

Acquire Business Licenses:

- Obtain the requisite business licenses aligned with your specific business activities.

Documents required to company registration in Bahrain

Streamlining the Process of Company Registration in Bahrain: A Guide to Essential Documentation

To initiate company registration in Bahrain, ensure you have the following requisite documents in order:

Properly Completed Application for Business Incorporation:

- Submit a meticulously filled application for business incorporation, providing accurate and comprehensive details.

Power of Attorney:

- Include the Power of Attorney to empower necessary actions, particularly useful in cases where direct access to certain processes is challenging.

Memorandum & Articles of Association:

- Present a thorough and well-crafted Memorandum & Articles of Association outlining the key aspects and governing principles of your business.

Registered Office Address Details:

- Furnish details of the registered office address, ensuring compliance with regulatory requirements.

Copies of Shareholders’ Passports:

- Include copies of passports for all shareholders, validating their identity and involvement in the company.

Copies of the Director’s Passports:

- Provide copies of passports for company directors, establishing their credentials and responsibilities.

Capital Deposited in the Bank:

- Demonstrate proof of capital deposition in the designated bank account, a crucial step in the company registration process.

Business entities for company registration in Bahrain

The various business entities for company registration in Bahrain are listed below:

1. Limited Liability Company (LLC):

Limited Liability Company (LLC), commonly referred to as With Limited Liability Company (WLL) is a common corporate type for international entrepreneurs and allows for 100% foreign ownership of the majority of enterprises. A limited liability company can have a maximum of 50 members and a minimum of 2 directors. The minimum required capital for an LLC is BDH 20,000.

2. Bahrain Shareholding Company (BSC):

Another name for a BSC is a public joint stock company. A BSC is best suited for companies that want to carry out significant financial and capital investments in large-scale projects. A BSC is best suited for companies who intend to register their businesses on Bahrain Bourse (BHB), the country’s securities exchange, in order to offer its stocks to the public. The required share capital to incorporate a BSC is BHD 250,000.

3. Companies Limited By Shares:

The joint partner and the silent partner are two different kinds of partners in companies limited by shares. This type of company needs at least 20,000 BD as share capital. There must be at least 4 individuals to form this kind of company.

4. Partnership Firm:

A partnership is an arrangement for two or more people to collaboratively work and split the business’ revenues. The partners’ liability is typically uncapped. It takes a minimum of two partners to create a partnership firm.

5. Branch Office:

An overseas branch office is only an addition to the parent corporation. The debts and obligations of the branch office would be the responsibility of the overseas parent corporation. A manager is required to oversee all branch office operations.

6. Single-Person Company:

A single-person company is owned by a single individual, and their liability for the business’s debts is limited to the amount of share capital they have invested.

Eligibility criteria for company registration in Bahrain

Eligibility Criteria for Company Registration in Bahrain :

- Shareholders: At least two shareholders for an LLC.

- Directors: Minimum one director for an LLC; at least three directors for a BSC.

- Capital Requirement: BSC requires a share capital of BHD 250,000; LLC requires a minimum of BHD 20,000.

- Registered Business Address: Mandatory for all formal correspondence.

Taxation Structure in Bahrain:

- Corporate Income Tax: Bahraini businesses are generally tax-free, except for mining, oil, gas, and refining industries, subject to a 46% tax rate.

- Value-Added Tax (VAT): Standard 10% VAT; exemptions for specific sectors like property transactions, financial institutions, insurance, food, and schooling.

- Stamp Duty: Applicable to real estate transactions at 2%.

- Municipality Taxes: 10% municipal tax for leasing business and domestic properties to foreign nationals.

- Social Security Contributions: Employer social security contributions are 12% for Bahraini employees and 3% for non-Bahraini employees, capped at BHD 4,000, based on monthly salary.

Cost for company registration in Bahrain

The cost to register a company in Bahrain is determined by a number of elements, including registration fees, document preparation costs, tax payments, acquisition of the legal address, etc.

- Bahraini company incorporation costs can begin at BHD 1000.

- It costs approximately BHD 100 to obtain an economic activity license.

- Investment Visa is charged at BHD 172.

- Additionally, work permits for workers are charged BHD 172 annually.

Why Choose Bahrain for Company Registration?

100% Foreign Ownership: Bahrain allows full foreign ownership, fostering an investor-friendly environment.

Modern Infrastructure: Boasting modern facilities and a robust transportation network, Bahrain supports business growth.

Strategic Location: Positioned for global business, Bahrain offers easy access to Middle Eastern and African marketplaces.

Ease of Mobility: International investors and expatriates enjoy unhindered movement, free from overly strict visa and work permit requirements.

Advantages of company registration in Bahrain

Experience a host of advantages when choosing Bahrain for your company registration:

Free Trade Agreements:

- Bahrain has inked multiple free trade agreements, fostering economic growth and reducing trade barriers. Notably, these agreements have led to a remarkable 32.60% surge in imports.

Tax Advantages:

- Enjoy a tax-friendly environment with no corporate income tax or withholding tax applied to Bahrain-incorporated businesses. Benefit from the strategic double taxation treaties, sparing entrepreneurs from dual tax obligations.

100% Foreign Ownership:

- Bahrain extends the opportunity of 100% foreign ownership to the majority of businesses, promoting an inclusive and investor-friendly climate.

Advanced Financial Sector:

- Globally recognized, Bahrain stands out as a leader in Islamic finance, boasting the highest number of Islamic financial organizations in the Middle East.

Conclusion

Nestled on the western shore of the Persian Gulf, Bahrain, a compact Arab nation, emerges as a strategic entry point into the global economy. Its proximity to Qatar and Saudi Arabia enhances accessibility, while a network of free trade agreements, double taxation treaties, and the promise of 100% foreign ownership amplifies its appeal.

For entrepreneurs eyeing Bahrain as their business home, this combination of geographic advantage and favorable business climate makes it an irresistible destination for company registration.

For personalized guidance and seamless company registration, turn to the expertise of Odint Consultancy. Our professionals stand ready to navigate you through the intricacies of registering a company in Bahrain, ensuring your business journey begins on the path to success.

FAQs: Incorporating a Firm in Bahrain

1. How do I incorporate a firm in Bahrain?

2. Why is Bahrain an ideal location for business incorporation?

3. Can a foreigner incorporate a business in Bahrain?

4. Do businesses in Bahrain pay taxes?

5. What are the advantages of incorporating a firm in Bahrain?

6. How much capital is needed to register an LLC in Bahrain?

Newsletter

Keep up to date — get updates with latest topics

RAK Business Setup in Bahrain offers expert guidance and seamless solutions for entrepreneurs looking to establish and grow their businesses in the dynamic Bahraini market.