- Diplomatic Area, Manama Centre, Kingdom of Bahrain

Call Us Today

Company Formation in Bahrain 2024

Company Formation in Bahrain is our expertise! Are you looking to establish your business in Bahrain? We provide comprehensive guidance and support for Company Formation in Bahrain, catering to the needs of both local and foreign entrepreneurs. With an updated and simplified process, Bahrain offers attractive opportunities for business growth and expansion.

In this guide, we will walk you through the step-by-step procedure and highlight the key benefits of Company Formation in Bahrain. Our team of experts at RAK Business Setup will assist you throughout the registration process, ensuring a smooth and hassle-free experience. Contact us today to get started on your journey of Company Formation in Bahrain.

Revolutionizing 2024: Streamlined Mastery for Effortless Company Formation in Bahrain

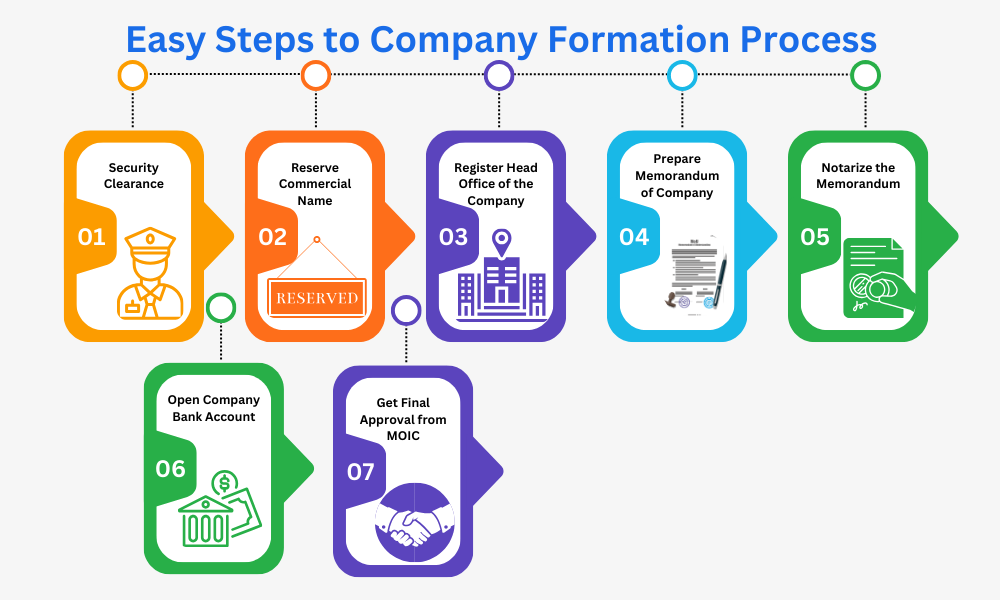

Step # 1: Security Clearance

Our team will guide you through obtaining security clearance approval, which is the first step in company formation in Bahrain. We will assist in preparing the necessary documents for company formation in Bahrain, including clear copies of passports, duly signed KYC forms, engagement letters, and authorization letters. The client’s IDs will then be submitted to the Nationality Passport and Residency Affairs Bahrain for approval, ensuring compliance with relevant regulations for company formation in Bahrain.

Once the security clearance is obtained, we will proceed with the next steps of company formation in Bahrain. This includes the submission of the required documents to the Ministry of Industry, Commerce, and Tourism, along with the payment of the necessary fees. Our experienced team will handle all the paperwork and liaise with the authorities on your behalf, ensuring a smooth and efficient process of company formation in Bahrain.

Furthermore, we will guide you through the selection of a suitable business structure, as per your specific requirements and objectives. Whether you opt for a sole proprietorship, partnership, or a corporate entity, we will provide expert advice to help you make informed decisions for company formation in Bahrain.

With our comprehensive support and expertise in company formation in Bahrain, you can confidently navigate the regulatory landscape and establish your business swiftly and effectively. Contact our team at RAK Business Setup today to get started on your journey of company formation in Bahrain.

Step # 2: Reserve Commercial Name

- With our expert guidance, select and reserve a unique commercial name that represents your business. this is the 2nd crucial step for company formation in Bahrain, We will assist in submitting the reservation request on your behalf, providing three proposed commercial names for consideration.

- Choosing an appropriate commercial name is crucial, as it reflects your brand identity and distinguishes your business from others in the market.

Step # 3: Register Head Office of the Company

- Once the commercial name is reserved, the next step to company formation in Bahrain, we will help you with the approval process for your company’s head office. This includes the endorsement of the office/shop/workshop Incubator commercial address.

- Our team will assist you in finding the most suitable business location that meets the requirements of your business. We will handle the submission of all necessary documents, such as shop photos, lease agreements, and EWA requirements.

Step # 4: Prepare Memorandum of Company

- One of the essential steps in company formation in Bahrain is the preparation of the memorandum of association and articles of association.

- Our team will work closely with you to draft suitable clauses tailored to your specific business structure.

- Once the draft memorandum is finalized and confirmed by you, we will submit the documents to the Ministry of Industry Commerce and Tourism (MOICT) for approval and further processing in the context of company formation in Bahrain.

- Our experienced professionals will ensure that the memorandum and articles of association comply with the legal requirements and regulations in company formation in Bahrain.

- We understand the significance of these documents in outlining the rights, responsibilities, and governance of your business. Therefore, we will meticulously review and refine the drafts to meet your unique business objectives.

- Once the documents are submitted to the MOICT, our team will closely monitor the approval process and handle any additional requirements or inquiries on your behalf.

- Our goal is to expedite the company formation in Bahrain process and ensure a seamless experience for our clients.

- At RAK Business Setup, we are committed to providing comprehensive assistance in company formation in Bahrain.

- From the initial stages of document preparation to the final steps of approval and processing, our team will be with you every step of the way.

- Contact us today to learn more about our services and start your journey of company formation in Bahrain.

Step # 5: Notarize the Memorandum

- The Next crucial Step for company formation in Bahrain is to ensure legal validity, the memorandum and other relevant documents will be attested by a public or private notary. Our experts will manage the entire process of notary attestation on your behalf, saving you time and effort.

Step # 6: Open Company Bank Account

- To facilitate business operations, it is mandatory to open a company bank account in Bahrain. We will guide you through the process, assisting you in selecting a suitable Bahraini bank and ensuring a smooth account opening experience.

- The company’s bank account will be opened in the desired bank, and the capital amount will be deposited in accordance with the regulations. We will provide a detailed checklist of the required documents and conditions to simplify the process for you.

Step # 7: Get Final Approval from MOIC

- As the final step, the notarized memorandum and bank certificate will be submitted to the Ministry of Industry and Commerce (MOIC) for official approval. Upon MOIC’s approval, your company formation will be declared officially.

- You will receive a sample of an active commercial registration, providing legal recognition for your business in Bahrain.

Key Benefits of Company Formation in Bahrain

Bahrain offers several advantages to foreign investors and entrepreneurs looking to establish a business. Here are the key benefits for company formation in Bahrain that you can avail:

- Investor Resident Permit: Foreign business owners can obtain a resident permit, allowing them to reside and work in Bahrain.

- 100% Ownership: Foreigners can have complete ownership of their business in Bahrain without the need for a local partner.

- Family and Employee Resident Permits: Business owners can secure resident permits for their family members and employees.

- Government Support: The Bahraini government extends support to businesses during the initial two years, providing assistance and resources.

- No Audit for the First Year: In the first year of operation, your business is exempt from audit requirements.

- No Income Tax: Bahrain does not levy income tax on individuals or corporations.

- No Corporate Tax: There is no corporate tax on profits generated by businesses.

- Easy Closing Process: If necessary, closing your business within two years can be a simplified and efficient process

Start Your Business in Bahrain with Ease

Company formation in Bahrain has been made easier and more streamlined with the updated procedures and systems in place. With RAK Business Setup’s expertise and guidance, you can navigate through the registration process seamlessly.

Take advantage of the attractive benefits offered by Bahrain to foreign entrepreneurs, including complete ownership, resident permits, government support, and favorable taxation policies. Begin your journey to success in Bahrain by contacting RAK Business Setup today.

Business Opportunities for Foreigners in Bahrain

Bahrain is a small island country in the Persian Gulf, known for its stability, security, and business-friendly environment. The country offers a range of opportunities for foreign entrepreneurs and investors to establish and grow their businesses.

One of the key advantages of company formation in Bahrain is the ability for foreigners to own 100% of the company. This is unusual in the Gulf region, where many countries have restrictions on foreign ownership. Additionally, Bahrain offers a range of incentives and benefits for businesses, including:

- 100% foreign ownership: Foreign investors can own 100% of a business in Bahrain, without the need for a local partner or sponsor.

- Investor resident permit: Business owners can apply for an investor resident permit, which allows them to live and work in Bahrain.

- Family resident permits: Business owners can also sponsor their family members for residence permits, allowing them to live and work in Bahrain.

- Employee resident permits: Businesses can sponsor their employees for resident permits, allowing them to live and work in Bahrain.

- Government support: The Bahraini government offers support for businesses, including foreign-owned businesses, through various initiatives and programs.

- No audit for 1st year: New businesses in Bahrain are exempt from audit requirements for the first year, giving them time to establish their operations and settle into the local market.

- No income tax: Bahrain does not impose income tax on individuals or businesses, making it an attractive destination for entrepreneurs.

- No corporate tax: Additionally, Bahrain does not have corporate tax, which means businesses don’t have to worry about paying taxes on their profits.

Newsletter

Keep up to date — get updates with latest topics

What is RAK Business Setup

RAK Business Setup is a leading business setup consultancy that provides assistance to foreign entrepreneurs and investors looking to company formation in Bahrain. Our services include:

- Company formation in Bahrain: We help our clients register their businesses in Bahrain, including assistance with documentation and licensing requirements.

- Business licensing: We assist our clients in obtaining the necessary business licenses and permits to operate their businesses in Bahrain.

- Investor resident permits: We help our clients apply for investor resident permits, which allow them to live and work in Bahrain.

- Family resident permits: We assist our clients in sponsoring their family members for residence permits, allowing them to live and work in Bahrain.

- Employee resident permits: We help our clients sponsor their employees for resident permits, allowing them to live and work in Bahrain.

- Business bank account opening: We assist our clients in opening business bank accounts in Bahrain, making it easier to manage their finances.

- Office space assistance: We help our clients find suitable office space in Bahrain, including assistance with lease agreements and other requirements.

At RAK Business Setup, we have a team of experienced professionals who are knowledgeable about the business setup process in Bahrain. We provide tailored solutions to our clients, ensuring that their businesses are set up efficiently and effectively. Contact us today to learn more about how we can help you to company formation in Bahrain.

Why Choose RAK Business Setup for Company Formation in Bahrain ?

Starting a business can be a daunting task, especially when it comes to navigating the complex process of company formation in Bahrain. However, with RAK Business Setup in Bahrain, the process just got a whole lot easier. Our team of experienced professionals can help you set up your business in the Kingdom of Bahrain quickly and efficiently, allowing you to focus on other important tasks.

At RAK Business Setup in Bahrain, we understand that every business is unique and has its own set of requirements. That’s why we offer personalized solutions tailored to your specific needs. Our team of experts will work closely with you to understand your business goals and advise you on the best organizational structure to suit your needs.

We have helped numerous local and foreign-funded businesses successfully register and establish themselves in Bahrain. Our services include:

- Company Formation in Bahrain

- Business licensing

- Investor resident permits

- Family resident permits

- Employee resident permits

- Help in Business bank account opening

- Office space assistance

- Offense Removing in CR

- All Types of Documents regarding your Business need

With our streamlined process and expert guidance, you can save time and avoid the hassle of dealing with complex paperwork and bureaucracy. Our goal is to make the process of company formation in Bahrain as smooth and stress-free as possible, so you can focus on growing your business.

At RAK Business Setup in Bahrain, we are committed to providing exceptional service and support to our clients. We believe in building long-term relationships and strive to be your trusted advisor for all your business needs.

So why wait? Contact us today and let us help you setup your business in the hub of the Middle East. We look forward to working with you and helping your business thrive in Bahrain.

Why a Company Formation in Bahrain?

Are you looking to set up your dream business in the Middle East? Look no further than Bahrain! Company formation in Bahrain is the first step to establishing your business in this thriving economy. By registering your business in Bahrain, you’ll be able to take advantage of numerous benefits and opportunities.

One of the biggest advantages of a company formation in Bahrain is the 0% corporate and income tax rate. This makes it an ideal location for offshore companies and startups looking to minimize their tax liability. Additionally, Bahrain offers a streamlined and efficient business registration process through its new commercial registers system, known as SIJILAT. This system provides a one-window application process, allowing you to easily submit and obtain approval for your business registration online.

Bahrain is also known for its investment-friendly business environment, with a variety of business structures available to suit your needs. You can choose from sole proprietorship, partnership, or company formations, with a With Limited Liability Company (WLL) being the preferred business structure for many entrepreneurs.

The Kingdom of Bahrain is a leading country in the GCC, with a strong economy and a wealth of opportunities for investment and innovative business ventures. The government is committed to supporting entrepreneurship and startups, providing an attractive business environment for both local and foreign investors.

At RAK Business Setup, we can help you navigate the company formation process and provide you with expert advice on the best business structure for your needs. Our team of experienced professionals will guide you through every step of the process, from registration to licensing and beyond.

Contact us today to learn more about how we can help you set up your business in Bahrain and take advantage of all the benefits this thriving economy has to offer.

Following are the advantages of company formation in Bahrain

- 100% foreign ownership: You can own and control your business entirely, without any restrictions.

- 0% corporate tax: Enjoy complete tax exemption on your business profits, making Bahrain an attractive destination for offshore companies.

- 0% income tax: No personal income tax means you can keep all your hard-earned money.

- No third-party involvement: Bahrain’s streamlined process eliminates the need for a local sponsor or partner, giving you full control over your business.

- Access to Gulf and global markets: Strategically located at the heart of the Gulf, Bahrain offers easy access to developed and emerging markets, making it an ideal hub for trade and investment.

- Businessman Visa: Get a visa specifically designed for business owners, allowing you to live and work in Bahrain.

- Work-Permits (Employee Visas): Bring your team to Bahrain with ease, thanks to our efficient employee visa process.

- Exceptional lifestyle: Enjoy a high standard of living in Bahrain, with modern infrastructure, luxurious living options, and world-class amenities.

- Free Zone Everywhere: Benefit from tax exemptions and other incentives in Bahrain’s numerous free zones, making it an ideal location for a variety of businesses.

- Strong currency: Bahrain’s currency, the Bahraini dinar, is pegged to the US dollar, ensuring stability and confidence in financial transactions.

By registering your company in Bahrain, you can unlock these advantages and take your business to new heights. At RAK Business Setup in Bahrain, we can guide you through every step of the process, from company formation to licensing and beyond. Contact us today to get started your 100% own Company formation in Bahrain.

5 Free Trade Agreements in Bahrain

The Kingdom of Bahrain has signed 5 free trade agreements (FTAs) with 22 countries, boosting business opportunities and reducing trade barriers. As a result, Bahrain’s imports have increased by 32.60%. The following are Bahrain’s FTAs:

- Greater Arab Free Trade Area (GAFTA): This FTA aims to promote trade and economic cooperation among Arab countries. By joining GAFTA, Bahrain can access a large market of consumers and resources, and benefit from reduced tariffs and trade barriers.

- Gulf Cooperation Council (GCC) Free Trade Agreement: This FTA aims to promote trade and economic integration among GCC member states. By joining the GCC FTA, Bahrain can access a large market of consumers and resources, and benefit from reduced tariffs and trade barriers.

- GCC-Singapore Free Trade Agreement (GSFTA): This FTA aims to promote trade and economic cooperation between the GCC and Singapore. By joining the GSFTA, Bahrain can access the Singaporean market and benefit from reduced tariffs and trade barriers.

- GCC-European Free Trade Association (EFTA) Agreement: This FTA aims to promote trade and economic cooperation between the GCC and EFTA member states. By joining the GCC-EFTA Agreement, Bahrain can access a large market of consumers and resources, and benefit from reduced tariffs and trade barriers.

- US-Bahrain Free Trade Agreement: This FTA aims to promote trade and economic cooperation between the US and Bahrain. By joining the US-Bahrain FTA, Bahrain can access the US market and benefit from reduced tariffs and trade barriers.

Overall, these FTAs can help Bahrain diversify its economy, increase its exports, and attract foreign investment, which can contribute to the country’s economic growth and development.

How many business structures are available for company formation in Bahrain?

Bahrain offers various business structures for company formation, catering to different needs and requirements. The legal system provides the following options:

- Individual Establishment (Sole Proprietorship)

- Single Person Company (SPC / Single Member Company)

- Bahraini Partnership Company (BPC / Partnership Company)

- With Limited Liability Company (WLL / Private Limited Company)

- Limited Partnership

- Bahraini Shareholding Company (BSC / Joint Stock Company)

- Branch of a Foreign Company

Government entities involved in company formation in Bahrain include:

- Nationality Passport & Residency Affairs

- Ministry of Industry, Commerce & Tourism

- Ministry of Works, Municipalities Affairs & Urban Planning

- Labor Market Regulatory Authority

- Other licensing authorities (depending on the type of business)

This variety of business structures and government support makes Bahrain an attractive destination for entrepreneurs and businesses looking to establish a presence in the region.

Why to open a corporate bank account in Bahrain

To incorporate a company in Bahrain, you’ll need to open a corporate bank account and deposit the authorized capital. Our expert team can help you open an account in just 1-3 business days. Here are the requirements for under formation companies in Bahrain:

- Personal presence of all shareholders

- Last 6 months’ bank statements of all shareholders

- Copy of commercial registration (CR)

- Original identification documents

- Account opening letter by company

- Capital amount in cash

With these documents, our team can help you open a bank account quickly and efficiently, ensuring your business is up and running smoothly.

What time required to complete a company formation in Bahrain

Looking to set up a business in Bahrain? Our team at RAK Business Setup can help you fast-track the company formation process, reducing the normal timeline of 30-45 working days to just 18-25 working days. We’ll work systematically to complete all the steps and approvals required to get your business up and running as quickly as possible.

Our services include:

- Expert guidance on company formation procedures

- Assistance with document preparation and submission

- Liaison with government authorities and agencies

- Fast-track processing of applications

- Comprehensive support throughout the process

With our help, you can start your business in Bahrain quickly and efficiently, without having to worry about the administrative hassles. Let us help you turn your entrepreneurial dreams into a reality!

What Cost require to Company Formation in Bahrain?

The cost of company registration in Bahrain varies based on factors such as the type of company and capital requirements. A typical With Limited Liability (WLL) company, with the minimum capital requirement, costs around 800 BHD ($2260). Specialized commercial registrations may incur additional costs. Our team can provide you with a personalized quote and guide you through the process to ensure a smooth and cost-effective company formation experience.

Strategic Business Optimization in Bahrain: Empowering Foreign Investors with a Comprehensive Guide

Welcome to the ultimate guide for foreign investors seeking to establish a successful business in Bahrain. Our expert knowledge will provide you with valuable insights into the favorable business environment, company formation, public disclosure, banking, regulatory bodies, and business development programs available in Bahrain. By the end of this guide, you’ll have a clear roadmap for your investment journey in the Kingdom of Bahrain.

Business Environment:

- Bahrain’s Business-Friendly Features:

- Free Zone Advantage: Bahrain offers a free zone area for businesses, offering an environment with no geographical restrictions.

- Tax Benefits: Enjoy a tax-friendly environment with 0% corporate tax, a modest 10% VAT, and a 0% income tax rate.

- Foreign Ownership: There are no restrictions on foreign ownership, allowing for 100% foreign ownership in most cases.

Company Formation in Bahrain:

2. Setting Up Your Business:

- Minimal Shareholders: Start your venture with as few as one shareholder.

- Maximum Flexibility: There’s no limit to the number of shareholders, offering maximum flexibility.

- No Local Director Requirement: You are not obliged to appoint local directors.

- No Residency Restrictions: Directors and shareholders can reside anywhere in the world.

- Capital Freedom: There are no specific capital requirements by law.

- Capital Variety: You can contribute capital in cash or kind.

- Debentures Option: Debentures are allowed for Bahraini Shareholding Companies only.

Public Disclosure of Annual Reports:

3. Transparency and Reporting:

- WLL Companies: No public disclosure of annual reports.

- Single Person Companies: No public disclosure.

- Bahraini Shareholding Company: Public disclosure is required.

- Foreign Branch: No public disclosure.

- Partnership Company: No public disclosure.

Banking:

4. Managing Your Finances:

- Personal Presence: Personal presence of shareholders is required to open a company account.

- Online Banking: Convenient online banking services are available.

- Corporate Debit Cards: Single-member companies can benefit from corporate debit cards.

- Account Types: Both current and savings accounts are accessible.

- Global Transactions: International funds transfer services are readily available.

Regulatory Bodies:

5. Navigating the Regulations:

- Commercial Register: Business registration falls under the Ministry of Industry, Commerce & Tourism (MOIC).

- Commercial Law: The Commercial Companies Law Bahrain DECREE LAW NO. (21) OF 2001 governs businesses.

- Employment Regulation: The Labour Market Regulatory Authority Bahrain (LMRA) oversees employment regulations.

- Tax Regulation: The National Bureau for Revenue (NBR) manages tax regulations.

Business Development Programs:

6. Empowering Your Business Growth:

- Incubation Centers: Utilize incubation centers to foster innovation and growth.

- Business Development Loans: Access business development loans to fuel your expansion.

- Government Support: Explore government support programs designed to assist businesses.

- Business Centers: Access dedicated business centers for streamlined operations.

Foreign Ownership:

7. Opportunities for Foreign Investors:

- Individual Establishment: Foreign investors, including Americans and GCC nationals, can establish individual businesses.

- Single Person Company: This structure is allowed for foreign investors.

- Partnership Company: Collaborate with local or international partners.

- Limited Liability Company: Form a company with limited liability.

- Limited Partnership: This option is open to foreign investors.

- Bahraini Shareholding Company: Explore opportunities in joint stock companies.

Conclusion: Bahrain provides a dynamic platform for foreign investors, offering a tax-friendly, transparent, and flexible business environment. With the support of various business development programs and an array of ownership options, your investment journey in Bahrain is poised for success. We encourage you to take the next step and explore the numerous opportunities that await in the Kingdom of Bahrain.

Frequently Asked Questions (FAQ) on Company Formation in Bahrain

By setting up a company in Bahrain, each shareholder will get a “Businessman/Investor” resident permit and resident permits for their dependents (spouse and children). Initially, you can avail 2 work-permits for your employees. Later, you can increase the work-permits by providing the workload document to LMRA

Yes, around 90% of the company formation procedure can be done virtually. However, personal presence is required to open a company bank account

- Passport copy

- NOC (for employees in Bahrain only)

- Power of Attorney or E-key

- Office address (electricity account)

- Memorandum of Association

- Capital Deposit Certificate

- In Bahrain, a company can be formed with just one shareholder. There is no strict requirement for multiple shareholders.

- No, there are no restrictions on the maximum number of shareholders in a Bahraini company, providing great flexibility in company structures.

- No, there is no requirement for local directors. Foreign nationals can serve as directors in Bahraini companies.

No, there are no residency requirements for directors or shareholders. You can manage your business from anywhere in the world.

By law, there is no specific minimum capital requirement. You have the freedom to determine your initial capital investment.

Yes, capital can be contributed in cash or kind, allowing for various ways to fund your business in Bahrain.

Debentures are allowed only for Bahraini Shareholding Companies, not for all company types.

Public disclosure requirements vary depending on the type of company. Bahraini Shareholding Companies are typically required to disclose annual reports, while others may not have the same obligation.

Yes, the personal presence of shareholders is typically required to open a company account in Bahrain.

Yes, Bahrain offers convenient online banking services to facilitate corporate transactions.

Yes, single-member companies have the option to obtain corporate debit cards to manage their finances effectively.

Businesses in Bahrain can open both current and savings accounts to meet their financial needs.

Yes, businesses in Bahrain can easily perform international fund transfers through local banks.

Key regulatory bodies in Bahrain include the Ministry of Industry, Commerce & Tourism (MOIC) for the Commercial Register, the Labour Market Regulatory Authority Bahrain (LMRA) for employment regulations, and the National Bureau for Revenue (NBR) for tax regulations.

Yes, Bahrain offers a range of business development programs, including incubation centers, business development loans, and government support initiatives to foster growth and innovation.

Foreign investors in Bahrain can establish various ownership structures, including

- individual establishments,

- single-person companies,

- partnership companies,

- Limited liability companies,

- Limited partnerships, and Bahraini

- shareholding companies (joint stock companies).

For Quick Call Back please fill the given form

RAK Business Setup in Bahrain offers expert guidance and seamless solutions for entrepreneurs looking to establish and grow their businesses in the dynamic Bahraini market.